Banks are bracing for a recession as Treasury yields surge

Bank stocks might be on pace for yearly losses as sharply higher interest rates take a toll, but the industry’s reserves are at the highest level in three decades, according to DBRS Morningstar.

Bank shares have come under more selling pressure since the Federal Reserve in September signaled it could keep rates higher for longer than earlier anticipated. The tough talk has dampened the year’s rally in stocks and reignited a dramatic selloff in the roughly $25 trillion Treasury market.

“Right now, there is nothing standing in the way of higher Treasury yields,” Kathy Jones, chief fixed-income strategist at Schwab Center for Financial Research, told MarketWatch. “It’s fairly obvious it’s not good for banks. The rise in yields has just been relentless.”

Higher yields on newly issued Treasury bonds erode the value of portfolios that include lower coupon debt issued when rates were lower. Banks also tend to hold large exposure to commercial property loans that could be difficult to refinance if rates stay higher for longer.

The S&P 500 index’s financial sector was down 5.5% on the year through Tuesday, according to FactSet, while the popular Financial Select Sector SPDR ETF XLF also was 5.5% lower in 2023.

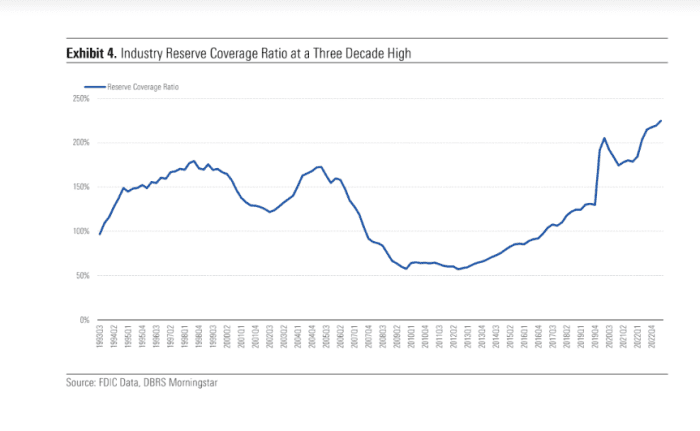

Still, a look at the banking industry’s reserve levels shows lenders are bracing for credit deterioration and losses to climb in the event of a recession. This chart shows banking reserve coverage as a portion of nonperforming loans at 225% as of the second quarter, the highest in three decades.

Banks bracing for a recession boost reserves to a 3-decade high

FDIC, DBRS Morningstar

“Although credit quality remained relatively benign even as the Fed started raising interest rates in March 2022, the industry has nonetheless been increasing its reserves,” DBRS Morningstar analysts Eric Chan and Michael Driscoll, wrote in a Tuesday report.

Their view is that while credit losses will continue to climb, banking reforms in the wake of the 2007-2008 global financial crisis put the industry as a whole in a position to “weather any potential storms.”

“That’s logical,” Jones at Schwab said about higher banking reserves. “They are saying: Things don’t look so great right now. I’m going to have to be more careful.”

Banks were exposed to an estimated $558.4 billion of unrealized losses in the second quarter on underwater securities, up 8.4% from the quarter before, according to the Federal Deposit Insurance Corp.

Banks, especially regional lenders, ramped up their exposure to commercial real estate in recent years when rates were low. Potential fallout from higher rates or a recession has been a focus at the Federal Reserve and the Treasury Department.

The year’s selloff in bank stocks has been more acute for regional players, with The SPDR S&P Regional Banking ETF KRE down about 32% on the year, according to Dow Jones Market Data.

Silicon Valley Bank’s collapse in March sparked fears of a broader banking crisis after it sold a large portfolio of securities at a sharp loss. The Fed responded with an emergency lending facility for banks to tap for liquidity to prevent forced asset sales. Demand for the facility spike in September but it also has helped shore up confidence in the banking industry.

The march higher in longer-dated Treasury yields has largely wiped out U.S. bond-market returns for the year. The popular iShares Core U.S. Aggregate Bond ETF AGG on Tuesday closed at its lowest level since October 2008.

Yields on the 10-year Treasury BX: TMUBMUSD10Y were at 4.80% on Tuesday, while the 30-year Treasury rate BX: TMUBMUSD30Y was knocking on the door of 5% at 4.92%, the highest in about 16 years, according to FactSet.

Jones at Schwab said the 10-year Treasury yield would need a catalyst to come back down, but that it could climb to 5% this year, or even 5.5%, in a “vastly oversold” scenario.

The Dow Jones Industrial Average DJIA on Tuesday turned negative for the year, while the S&P 500 index SPX trimmed its yearly gain to about 10.2% from 17% in late August, according to FactSet.